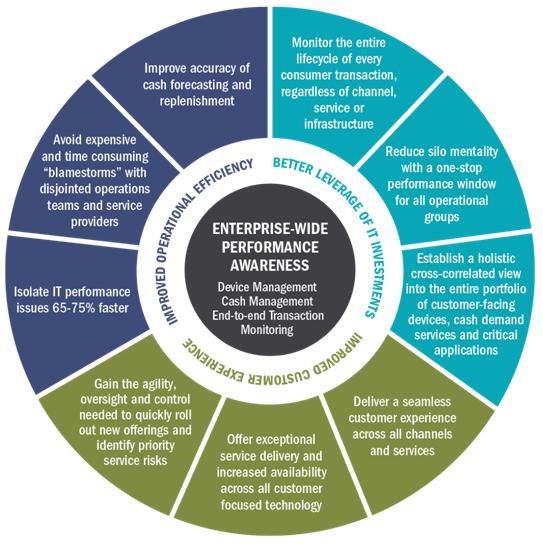

This week, NCR and INETCO hosted a BAI Banking Strategies webinar. It featured industry experts suggesting ways that banks and credit unions can use ATM management, business transaction management and cash optimization technologies to achieve enterprise performance awareness across their ATM and multichannel banking environments. Key tips to achieving enterprise-wide performance included:

1) Combine industry leading cash optimization, device management and end-to-end transaction analytics (otherwise known as business transaction management) into one offering. This would make it easier to accept more transactions, critical banking applications and customer-focused technologies; resolve performance problems with multiple characteristics and quickly identify the source of one (or more) points of bottleneck or breakdown; maintain control and provide assurance over device performance, cash management and service delivery.

2) Obtain access to the most granular performance information available on ATM status, cash tracking and transaction performance. This detailed intelligence is what you need to deliver a seamless customer experience across multichannel banking environments; improve intraday cash forecasting at the ATM and branch level; and reduce costs associated with cash replenishment.

3) Create a one-stop user interface. Having your IT operations, applications support and channel delivery teams working from a common source of data will lead to greater operational efficiency through 65-75% faster problem isolation; a breakdown of silos to make more information available to more people; and greater leverage of IT investments across multiple channels, services and operations teams.

Throughout the webinar, the BAI audience also participated in polls that uncovered some interesting results:

- Over 90% felt there are noticeable performance issues with customer transactions and services that their current monitoring solutions miss.

- Less than 30% has deployed a holistic, enterprise-wide awareness system that covers device management, transaction monitoring and cash optimization.

- The majority of BAI’s audience felt that their performance visibility gaps were most prominent in mobile transactions (87%) and payment transactions (47%). 40% of the audience also felt pain when it came to monitoring online banking and branch transactions, as well.

Given this data, it was not surprising to also discover that over 50% of the audience was planning to make an investment in technologies that could enhance consumer service quality and reduce costs within the next 12 months. It felt great to confirm that predicting consumer transaction patterns, reducing unacceptable network/critical banking application performance variability, and delivering a consistent consumer experience across ATM and other banking channels – of course in a more efficient, cost effective way – is indeed ranked high in priority for 2014.

If you are interested in learning more on how NCR’s ATM management and cash optimization experience, combined with real-time transaction monitoring and application performance analytics from INETCO, gives you a one-stop source for enterprise-wide performance data, you can either read this whitepaper or watch this BAI Banking Strategies webinar.