As technical infrastructure manager for a global payment services provider, Paul Grieve knows, first-hand, the value of monitoring electronic transactions. He is responsible for ensuring large credit and debit transactions are processed, without a hitch, for high-net-worth customers spread over 14 Middle East and North Africa countries.

As technical infrastructure manager for a global payment services provider, Paul Grieve knows, first-hand, the value of monitoring electronic transactions. He is responsible for ensuring large credit and debit transactions are processed, without a hitch, for high-net-worth customers spread over 14 Middle East and North Africa countries.

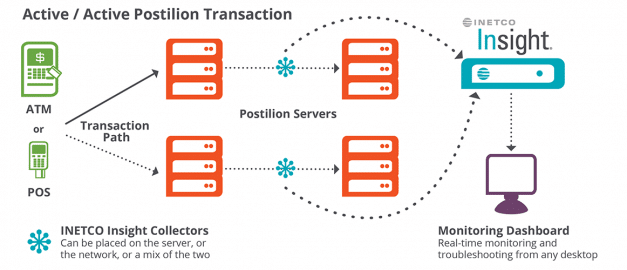

The life cycle of these electronic transactions spans a payments network comprised of two data centers, a third-party telecom, and 54 other ATM, POS and back-end services. The Company had also implemented a Postilion active/active architecture that could route a transaction through different servers based on transaction volumes experienced at any given time.

Because end customer experience is paramount, even a one-second improvement in transaction speed translates into significant returns.

With INETCO Insight, a network-based, real-time transaction monitoring software platform for banking and payment processing environments, Paul and his team were able to improve mean transaction times by an average of 2 seconds.

INETCO Insight’s unique ability to capture and correlate the transaction payloads and application response times across the entire life cycle of each electronic transaction makes it easy to know what the customer is experiencing, how networks and applications are responding and what the business value of each transaction is from a revenue or service perspective.

Other key benefits included:

- Faster isolation of issues within their network and a decrease in repair times by 65%

- A decrease in authorization times by 33%

- Eliminated 75% of transaction time-outs caused by internal network components

Download the case study, watch the recorded webinar or read the ATM marketplace article to learn how making good use of an always-on data source – electronic transactions – can help you improve customer experience across all your banking channels.

A big thanks going out to Paul, ATM Marketplace and INETCO partner Stanchion, for sharing this story and delivering one of our best webinars ever!