Newsflash: Data is big, and it’s everywhere.

Ok, maybe this is old news. Most of us are already aware of the opportunities (and frustrations), connected with exploding amounts of big data. The problem is much of that information has little to no value. And working through infinite data sets using traditional data warehousing appliances and analytics tools requires a level of advanced expertise held by few in your financial organization.

But what if you could cut through the big data noise, and easily access quality data that provides real value to your business unit? Yes – we are talking data that actually answers a business question!

For example, let’s take a look at transaction data, gathered across all channels and card schemes of a retail banking organization. There are many different stakeholders that will have many different uses for this data:

- IT operations teams can use transaction data to continuously monitor the performance and availability of critical applications, networks, third party services, devices and host authorization systems.

- Channel managers would be more interested in using this real-time data to understand the customer experience and make timely, business decisions around customer usability trends, product placement and channel profitability.

- Risk management and security teams would be looking to use this data to quickly identify fraudulent transaction activity.

Each business unit requires access to different parts of the same transaction data set. The creation of multiple business lenses, so to speak. Pretty powerful if you can do it, don’t you think?

At INETCO we help business units access the data intelligence that’s relevant to them. Intuitive visual displays and advanced data preparation tools help business managers and operations teams to transition from big data intelligence gathering to more advanced analytics – with minimal IT involvement and technical training required.

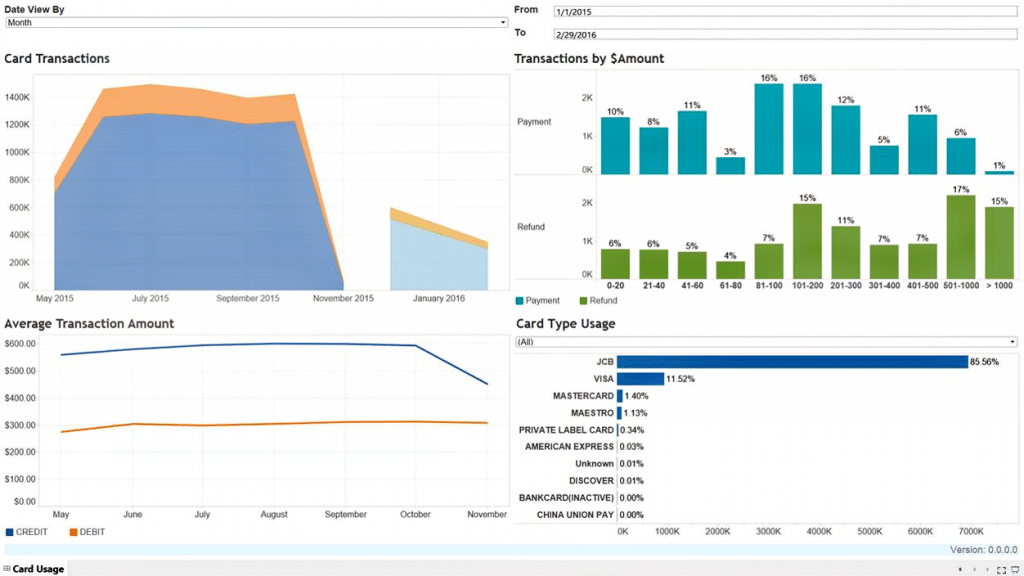

Recently, INETCO released a vertical-specific solution pack for card analytics. The INETCO card analytics solution pack is designed to help banks and card service providers move away from the “big data” noise, and gravitate towards a new level of smart, actionable business intelligence when it comes to:

- Understanding customer card and mobile wallet usage

- Managing potential fraud risks, EMV fallbacks and card system performance

- Analyzing interchange costs and revenues based on transaction types, card types and volumes

We encourage you to check out this solution, and would love to answer any questions you may have about cutting your big data noise. In addition to card analytics, INETCO solutions can also be applied to omni-channel banking, ATM, POS, branch and digital banking environments. For a full discussion around the INETCO solutions, contact INETCO.