ATM Analytics

Gain insights on cash utilization and improve your channel profitability with real-time ATM analytics.

Increase ATM channel profitability, reduce payment failures, and grow your business by harnessing rich transaction data with INETCO Insight for Payment Analytics.

Improve profitability

Analyze ATM placement and usage to see hot spots and queue patterns. Reduce service failures, lower expenses, and uncover ways to improve transaction completion rates.

Simplify reporting

Get all the ATM analytics & data you need in one ATM monitoring dashboard. Build reports and forecasting models 75% faster. Reduce time to gather transaction data. Generate on-demand reports easily.

Know customers better

Monitor customer transaction flows and find out what services matter to them. Discover locations that present opportunities for customer acquisition.

ATM analytics dashboard examples

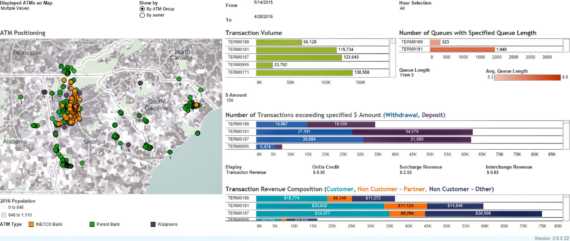

ATM CHANNEL USAGE — HOW DO I INCREASE MY ATM CHANNEL PROFITABILITY?

Gain insight into customer and non-customer transactions volumes for every ATM in your fleet. See a breakdown of revenues by interchange, surcharge and on-us credit. Analyze queue length patterns and their impact on ATM profitability with ATM monitoring dashboards.

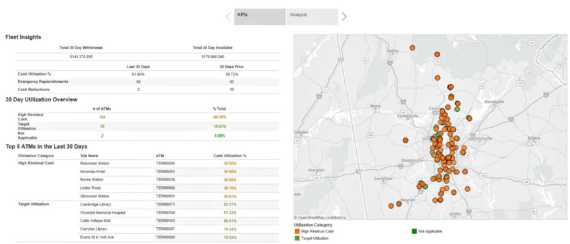

ATM ANALYTICS EXECUTIVE VIEW — HOW IS MY ATM BUSINESS PERFORMING OVERALL?

Gain a one-stop real-time view into the business performance of your ATM fleet. Compare monthly ATM channel costs, revenues and profits. See where your top and bottom performing ATMs are located. Understand ATM failures and overall transaction completion rates.

ATM PLACEMENT — WHERE SHOULD I PLACE (OR DECOMMISSION) MY NEXT ATM?

Examine locations to place new ATMs or move existing ones. See the locations of competitor ATMs on a map. Analyze transaction volume trends, demographic hotspots and queue patterns to optimize your ATM placement.

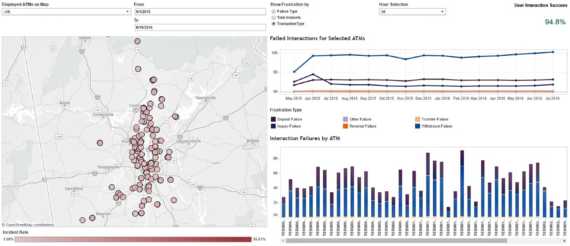

ATM FAILURES — WHY ARE CUSTOMER TRANSACTIONS NOT COMPLETING AS EXPECTED?

Identify transaction failures at an ATM that are impacting revenue and end customer experience. Track interaction success rates, incident rates and the root causes of incomplete transactions for every ATM.

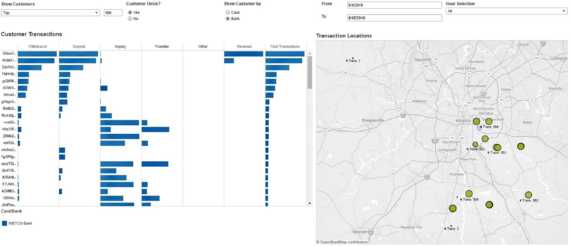

ATM TRANSACTION MIX — WHAT SERVICES MATTER TO MY CUSTOMERS?

Study customer transaction flows and time spent on interactions. Know when transaction duration is too long and identify ways to streamline operations. Monitor the impact of format changes or screen changes.

ATM CASH UTILIZATION — HOW ARE MY CASH LEVELS AT EACH ATM?

See cash utilization and replenishment at each ATM. Monitor the performance of cash management strategies to both reduce dead money in the fleet, and avoid the need for emergency cash replenishment.

ATM CUSTOMER LOCATIONS — WHERE ARE CUSTOMERS INTERACTING WITH ATMS?

Identify locations that present opportunities to provide better service to existing customers. Focus new customer acquisition efforts in high non-customer ATM usage areas.