Digital banking analytics

Improve mobile and online channel profitability with digital banking analytics. Evaluate customer engagement and spending shifts, perform digital payment forecasting, all within one platform.

INETCO Insight for Payment Analytics empowers you to make informed decisions on mobile and online channel growth in real-time.

Real-time insights

Shed light on digital channel usage and card profitability with real-time data analytics. Review and respond nimbly to errors and issues to avoid losses.

Efficient reporting

Save time and resources getting to the bottom of issues. Quickly perform digital payment forecasting. Analyze all the data in a single, customizable platform.

Increased profitability

Identify customer spending shifts in real-time and create new programs to increase customer engagement or improve channel performance.

Digital banking dashboard examples

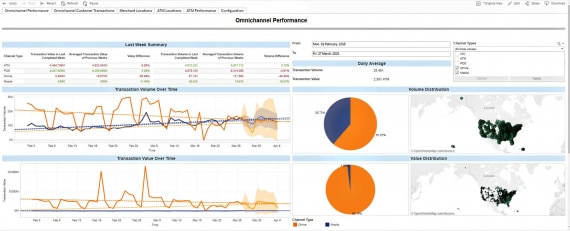

MOBILE AND ONLINE TRENDS — ARE BANKING AND CONSUMER SPENDING HABITS SHIFTING?

Use data analytics to evaluate customer interactions within your digital banking channels. Analyze the performance of your online and mobile channels, based on customer interaction volumes, values and percent changes from week to week. Increase usage of mobile and online applications through better service alignment.

CARD, DIGITAL WALLET, AND INTERCHANGE FEE ANALYSIS — HOW PROFITABLE ARE MY MOBILE AND ONLINE CHANNELS?

View the current and ongoing usage of individual card types and rails with digital banking analytics. Understand how each of the individual card types contribute to revenue. Spot a rise in debit card usage for online purchases, digital wallet card activation, reward programs that are consuming too large a portion of your interchange.

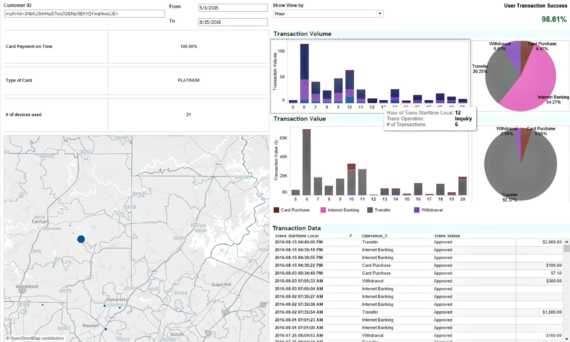

DIGITAL CHANNEL PERFORMANCE — WHICH ERROR RATES ARE IMPACTING CUSTOMER EXPERIENCE AND REVENUES?

Understand lost revenue by transaction error type and forecast the revenue impact of outstanding performance issues or outages. Prioritize your time on issues having the biggest impact on profitability and the end customer experience, based on data analytics.

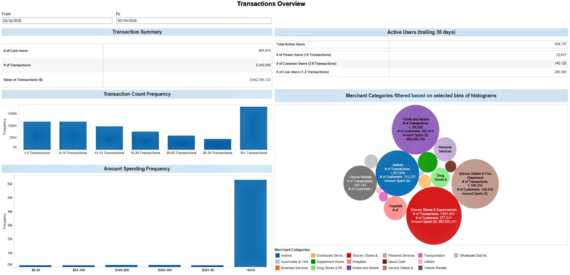

CUSTOMER SPENDING SHIFTS — WHERE ARE CUSTOMERS SHOPPING AND WHERE ARE THEY SPENDING?

Identify shifts in online and mobile consumer spending. Observe the variance between the number of transactions and the amount of money spent. Identify if average transaction values are decreasing. Compare various time periods to see how customer buying habits and card usage behaviors are changing. Utilize the digital banking trends and customer behavioral data to create new programs that will increase engagement.

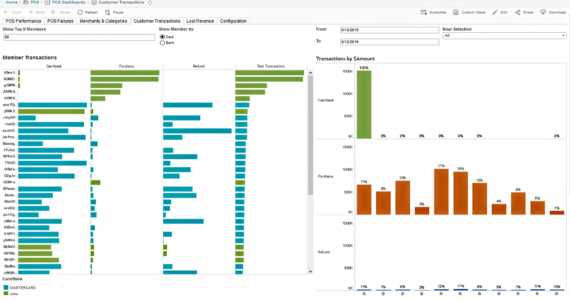

CUSTOMER SEGMENTATION — WHO ARE MY BEST CUSTOMERS?

Segment the most active customers based on transaction volumes, activity and card types. Use digital banking and customer analytics to break down customer transactions by customer segment and note usage patterns, such as an abundant number of refunds being performed.