INETCO BullzAI® for payment fraud prevention

Minimize customer friction and false declines, while keeping payments secure from complex fraud.

Protect your reputation

Detect more payment fraud and cyberattacks in real-time without added latency. Block fraudulent transactions before they complete in real-time without interrupting legitimate payments.

Keep customers happy

Your customers expect a seamless, instantaneous experience. Win them over by reducing the incidence of falsely declined transactions or service interruptions due to network attacks, while still keeping payments secure.

Increase your revenue

Increase channel profitability by using more precise payment intelligence and fraud detection and blocking technology. With INETCO BullzAI, you’ll be able to reduce losses from false positives and false negatives, malicious network attacks, and cyber crime.

for payment fraud prevention

Built specifically for payment environments, INETCO BullzAI helps financial institutions and merchants protect their payments from sophisticated financial crime and cyberattacks. Compared to other fraud solutions, INETCO BullzAI can detect fraud early in the process and block only suspicious activity letting the legitimate payments come through.

The INETCO BullzAI advantage

Provides an additional, essential layer of protection that integrates with or replaces your existing fraud prevention suite:

- Real-time data capture for every transaction channel

- Acquires network and application data which other fraud detection solutions can’t access

- Sees data fraudsters hide from other solutions

- Captures on-us and off-us traffic as well as application payload data

Delivers faster time to value:

- Includes machine learning features out-of-the box

- No training data required

- No data scientist required

- Trains on as few as 3-5 transactions

Detecting and blocking fraud for PT. ALTO Network

“Together, with world-class partners such as INETCO, we can actively work to prevent card present and card-not-present fraud attacks. We want to make customers feel safe when it comes to digital payment migration and help our member banks protect themselves against financial loss and a tarnished reputation – neither of which can be easily recovered.”

Why INETCO

- 75%+

- Mean-time-to-detect fraud is reduced by >75%

- 6

- Leading payment processors among our clients

- 80%

- Clients isolate payment performance issues 80% faster

Resources & FAQs

-

What is INETCO BullzAI for Payment Fraud?

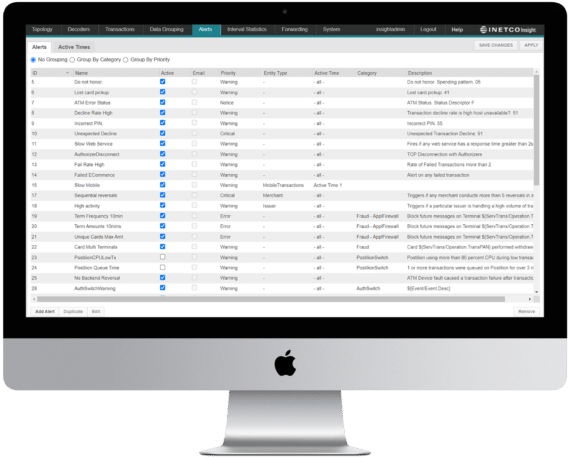

INETCO BullzAI is an advanced analytics solution that identifies, tracks, and prevents real-time payment fraud. The solution uses machine learning and advanced analytics techniques to detect anomalies and suspicious activities, alerting the financial institution to take appropriate actions.

-

What kind of payment fraud does INETCO BullzAI detect?

INETCO BullzAI detects various types of payment fraud, including card-present and card-not-present fraud, transfer fraud (ACH, wire, etc.), internal fraud, advanced persistent threats, account takeover fraud and more.

-

How easy is it to implement INETCO BullzAI?

INETCO BullzAI is designed to be easy to implement and deploy, with a user-friendly interface and straightforward configuration options. INETCO BullzAI can be deployed in the private cloud, public cloud, on premise or hybrid environments. Deployment is light touch. No large IT project is required. The system can be customized to meet the specific needs of each financial institution.