Fraud detection solutions for financial crimes & cyber attacks

INETCO helps to keep your business safe from sophisticated cyber threats and payment fraud, where other solutions fail.

INETCO's Payment Fraud & Cybersecurity Solutions

For payment fraud prevention

Minimize customer friction and false declines, while keeping payments secure from complex payment fraud.

Cybersecurity for Enterprise

Protect your business from zero-day and sophisticated cyber attacks other solutions can’t detect. Secure your online presence and critical infrastructure.

For payment transaction monitoring

Isolate payment performance issues that are impacting revenue and reputation up to 80% faster.

For payment analytics

Make better and faster business decisions based on your transaction data, gathered across all your payment channels in real-time and presented in one single dashboard.

FIGHT CARD & PAYMENT FRAUD

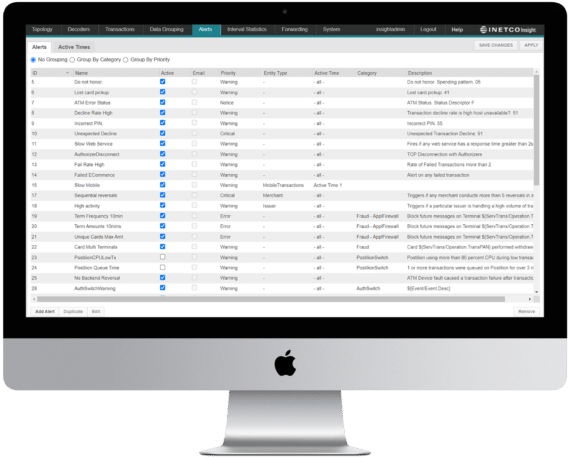

Protect your business from payment fraud (including card-not-present fraud) with a combination of real-time data acquisition, rules-based alerts & machine learning.

DETECT ACCOUNT TAKEOVERS EARLY

Reduce the risk of account takeover attacks before any damage to your business is done. You’ll know who your customer is even before they place an order or make a payment.

STAY RESILIENT TO CYBER THREATS

Get real-time data on cyberattacks and potential cyber threats to your business to stay ahead of financial criminals.