Debit and credit card analytics

Make faster, smarter decisions around debit and credit card profitability and portfolio offerings. Gather rich transaction data analytics from all your payment channels.

Increase the value of every transaction and grow your business by harnessing your payment data from every channel across the entire payment journey.

Improve profitability with card analytics

Analyze the performance of multiple card types and find shifts in spending habits or payment trends. Find new ways to deliver more value, lower risks and expenses, or improve channel performance.

Simplify reporting

Get all the data you need in one platform and build reports and forecasting models 75% faster. Reduce time to gather transaction data and extract insights. Easily generate reports on-demand.

Acquire new customers

Understand reward program activity and digital wallet usage. Find new ways to acquire new customers by gathering insight from your transaction data. Analyze how to target new service offerings.

Dashboard examples for card analytics

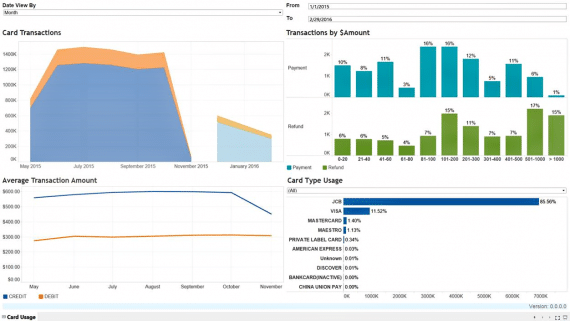

CARD EXECUTIVE OVERVIEW — HOW ARE MY DEBIT AND CREDIT CARDS CONTRIBUTING TO REVENUE?

Enable transaction data analytics to analyze the engagement of the debit and credit users over the last week and compare to the 90-day average. Understand how each of the individual card types is being used, and the interchange fees associated with each transaction. See how many payment cards are being successfully activated within digital wallets. Understand if reward programs are consuming too large a portion of your business revenues.

CARD USAGE — WHICH DEBIT OR CREDIT CARDS ARE MOST OFTEN BEING USED?

Analyze the performance of individual or multiple card types and networks based on volume. Gain a consolidated view of customer usage across all card rails. Forecast expected transaction volumes and amounts for these channels. Identify early trends or unexpected patterns. Note the effects of waived or reduced card and account fees.

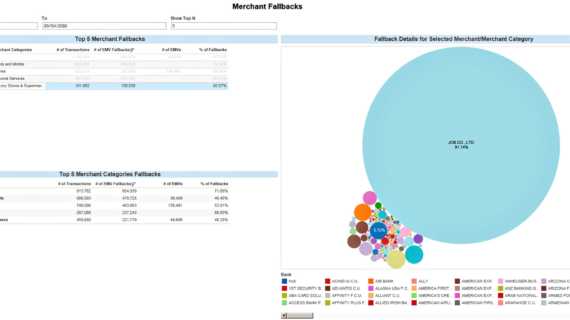

EMV FALLBACKS — WHICH MERCHANTS OR BANKS HAVE SIGNIFICANT FALLBACK TRANSACTIONS?

Review merchant EMV fallback transactions and high reversal patterns. Use debit and credit card analysis to investigate whether these are occurring due to an incorrectly configured chip reader terminal or a defective chip card. Avoid liability and shut down potential card fraud.

CARD FAILURES — WHEN ARE THERE PARTIAL OR COMPLETE CARD TRANSACTION FAILURES?

Analyze transaction success rates, incident rates and locations of failed cashback, deposits, inquiries, purchases, and refunds. Quickly respond to issues causing customer frustrations and distrust. Map out problem areas to investigate using transaction data analytics. Identify where it makes sense to increase limits on card-present and card-not-present transactions.

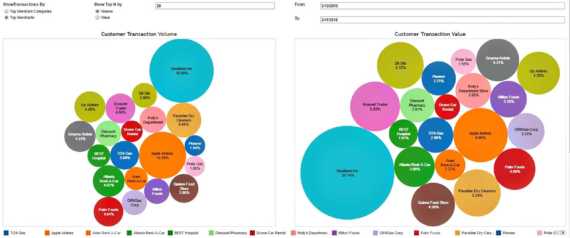

CARD USAGE BY MERCHANT CATEGORY — WHICH MERCHANTS ARE FREQUENTED MOST?

Credit and debit analytics allow you to identify the top merchants based on the number of transactions and the value of the transactions. Note shifts in spending habits, and align rewards programs based on where your customers are shopping and what they are buying.

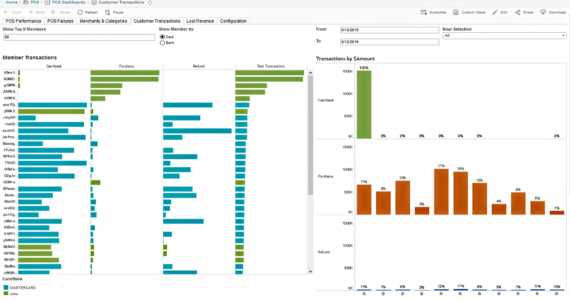

CUSTOMER SEGMENTATION BY CARD USAGE — WHO ARE MY MOST PROFITABLE CARD USERS?

Segment the most active customers based on transaction volumes, transaction types and card types. Use debit and credit card analysis to investigate suspicious fraudulent activity such as an abundant number of refunds, purchases or high volume transactions occurring.