Account takeover fraud prevention

Detect suspicious activity across the payment journey, blocking impersonation attempts & ATO attacks in real-time.

Real-time risk scoring and blocking

With INETCO BullzAI, you can differentiate legitimate users from potential cybercriminals in real-time. Our software blocks bad actors before they use stolen credentials or make unauthorized purchases.

Automated protection and continuous monitoring

Automatically detect and block suspicious activity on your accounts along the entire transaction journey. Know what’s happening in real-time and protect your customers and resources before account takeover fraud happens.

Reduced customer friction and system downtime

Block fraud, not legitimate payments. Behavioral analytics and machine learning models help you know your customers better and accept real transaction with less friction.

-

In 2021, losses from account takeover fraud were estimated to be over US$12 billion.

How it works

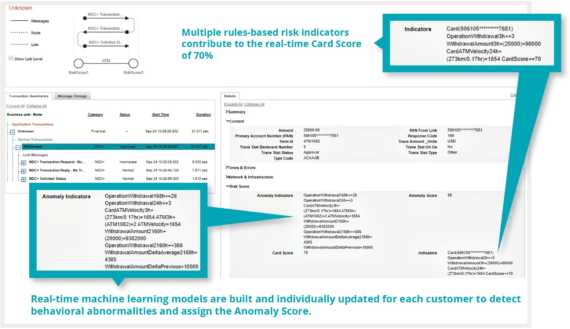

Adaptive Machine Learning and Risk Scoring

INETCO BullzAI continuously monitors and assesses individual customer activity and compares it to a unique adaptive machine learning model and behavioral analysis maintained for each individual card and customer. INETCO BullzAI captures and analyzes transaction data in milliseconds, rebuilds each customer model on the fly, and assigns risk advice for every transaction in real-time.

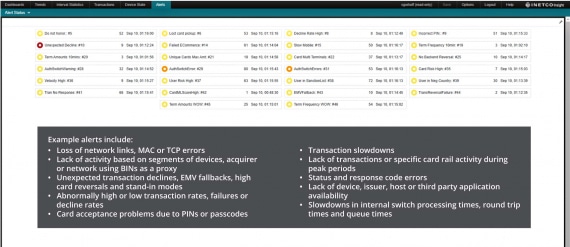

Transaction-level Event Monitoring

INETCO BullzAI uses transaction-level event monitoring to screen each network link of a payment transaction as it moves along each customer journey endpoint, application, and infrastructure. This makes it possible to continuously assess and react to suspicious transaction activity related to ATO fraud.

What our customers say

Payment Fraud Prevention for PT. ALTO Network

“Together, with world-class partners such as INETCO, we can actively work to prevent card present and card-not-present fraud attacks. We want to make customers feel safe when it comes to digital payment migration and help our member banks protect themselves against financial loss and a tarnished reputation — neither of which can be easily recovered.”