INETCO Insight® for payment analytics

Make better and faster business decisions based on your transaction data, gathered across all your payment channels in real-time and presented in one single dashboard.

IMPROVE PROFITABILITY THROUGH SMARTER DECISIONS

Take advantage of on-demand payment analytics and business intelligence streaming, combined with leading-edge AI and machine learning, to make timely data-driven business decisions.

INCREASE CUSTOMER ENGAGEMENT AND DEEPEN CUSTOMER KNOWLEDGE

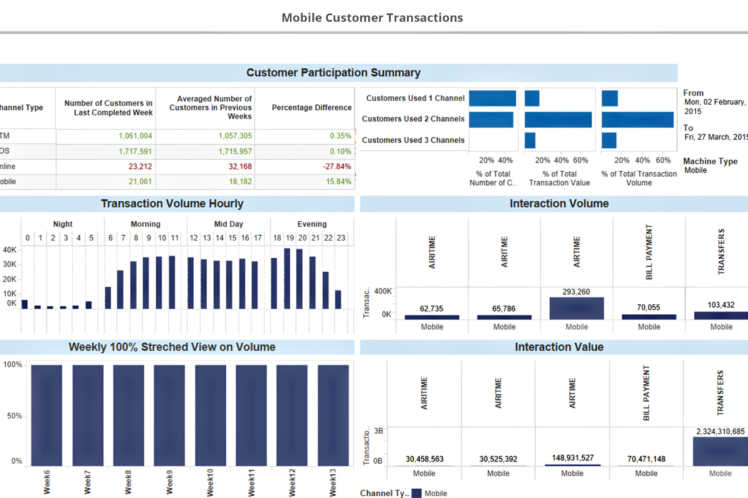

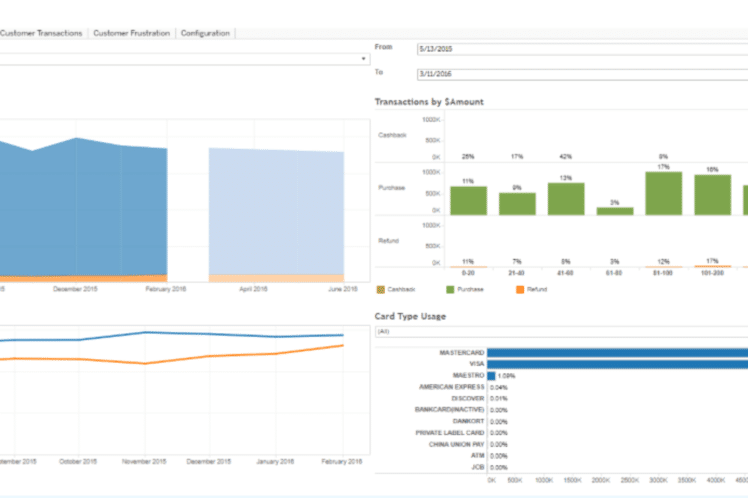

Access rich records of every customer interaction to spot top customers, identify customer acquisition opportunities, and analyze card usage across all payment channels.

SPEED UP REPORTING AND PAYMENT ANALYSIS BY >75%

Reduce the expensive, resource-intensive cycles it takes to gather payment transaction data. Build reports, forecasting models, and predictive algorithms for payment analytics.

For payment analytics

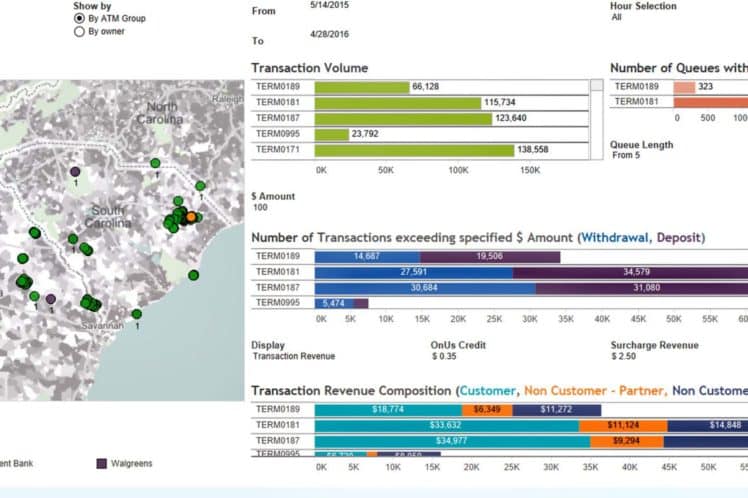

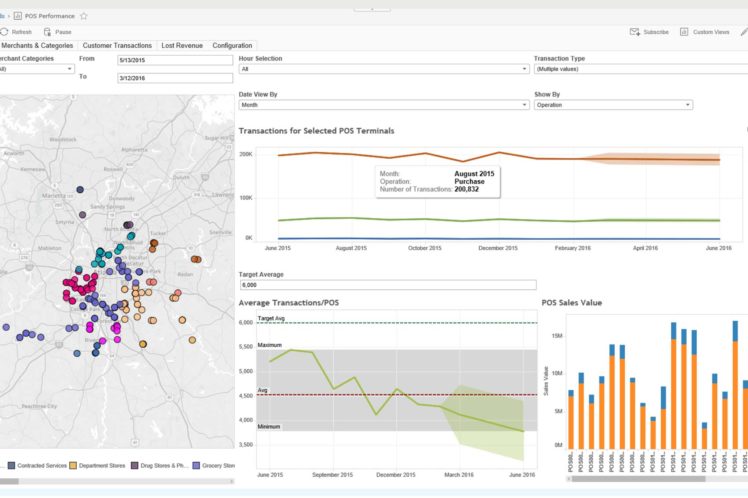

With a full 360-degree view of card usage, channel performance, and customer engagement, you can quickly extract payment intelligence and identify new ways to acquire customers, deliver more value to existing ones, prevent payment fraud, and enhance profitability through faster reporting, better device placement, and targeted service offerings.

Key INETCO Insight for payment analytics features

Simplified payment data acquisition in real-time

Centrally collect real-time transaction data across all card and payment channels, without complicated deployment.

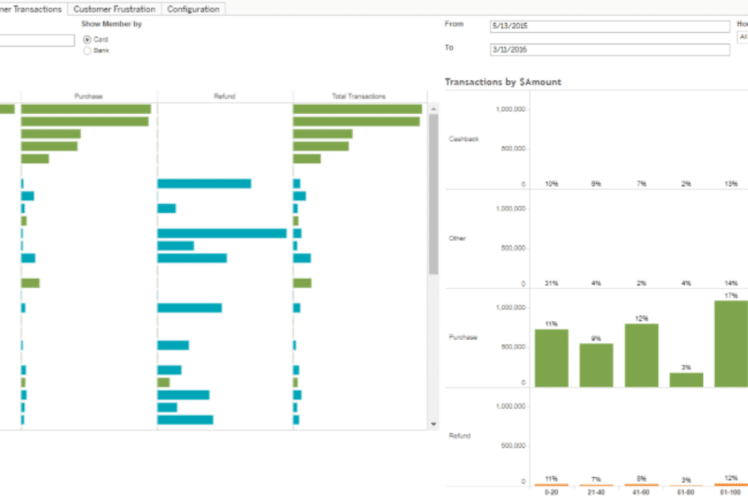

Tailored on-demand reporting

Easily generate reports on customer usage, card profitability, and channel performance, and see them in dynamic dashboards.

Configurable machine learning models and predictive algorithms

Quickly recognize patterns and predictions related to risk scores, queue lengths, cash flow forecasting, revenue, card usage, and customer buying behaviors.

Reliable payment data streaming and forwarding

Forward data to analytics applications or data lakes of choice, including Tableau and Microsoft Power BI.

What our customers say

Real-time payment intelligence for Woodforest National Bank

“...Woodforest has been able to take a multi-faceted approach to real-time transaction intelligence. This data strategy has measurably paid off in terms of operational efficiency, customer experience and branch profitability.”

Payment analytics dashboard examples

Resources

How Woodforest National Bank Improves Customer Experience, ATM Management and Branch Profitability with Real-time Transaction Monitoring and Analytics

How BECU Enhances Member Experience with Real-time ATM Transaction Intelligence