Payment fraud solutions for retailers

Drive new digital revenue streams, reduce chargebacks and deliver seamless omni-channel retail operations without interruptions from network issues, fraud or cyber attacks.

What our customers are saying

“Now rather than five people getting a phone call at 3AM to let them know something isn’t working, when I arrive in the morning one of my operators is able to tell me that there was a problem and that they were able to take care of it on their own. Through the improved service delivery, faster problem isolation and reductions in failed revenue - generating transactions, we achieved a full return on our INETCO Insight investment within four months.”

Customer success

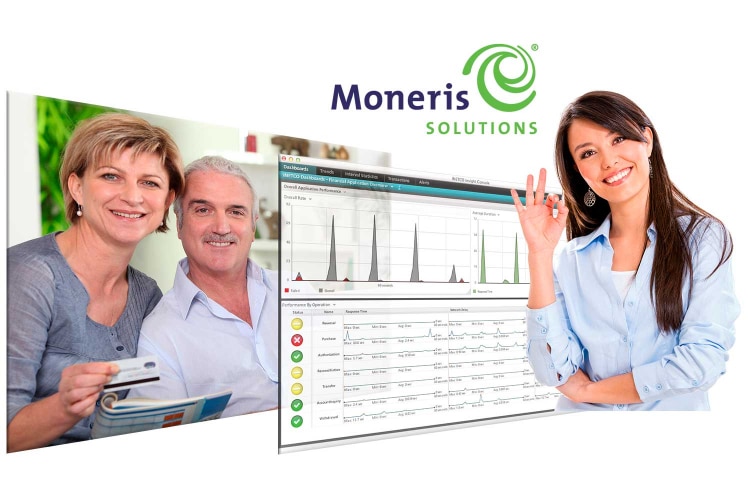

Moneris Solutions – Monitoring payment applications in over 350,000 merchant locations

How BKM Improved Service Level Delivery through End-to-End Transaction Visibility