Analytics can be like a boost of caffeine to any banking channel manager’s day. Take for instance, our fictitious card operations manager, Cary Agos. Cary is responsible for maintaining the cards side of the business at a very large bank. It’s his job to create more value for customers, mitigate the risks associated with fraud, and improve the profitability of the cards channel. Cary is always on the lookout for ways be more effective.

Recently, Cary has developed a love for on-demand card analytics. Why? Cary is able to get to the answers he needs to run his business unit better, even though he is a statistics and analytics novice. Take for instance 3 use case scenarios:

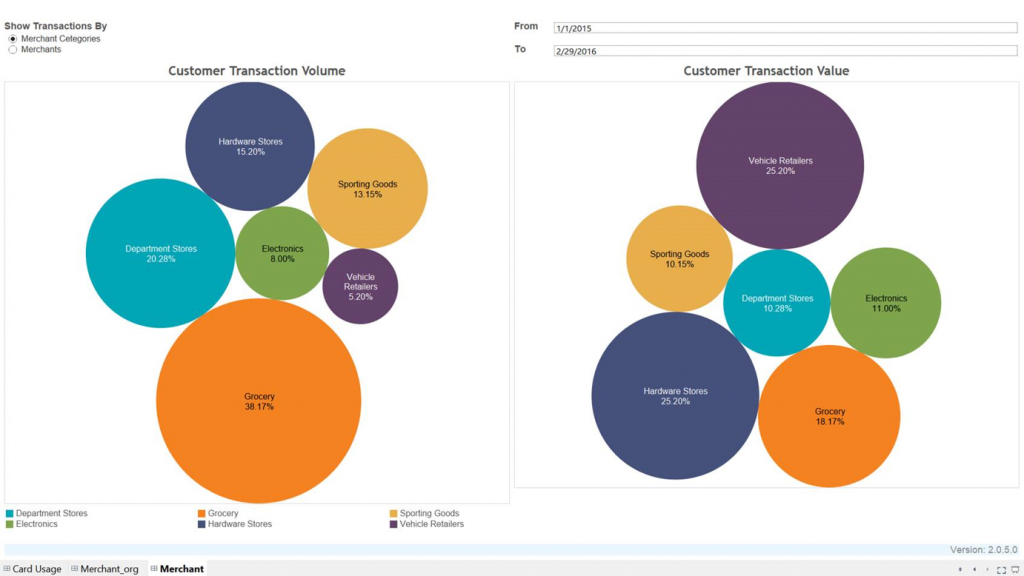

Increasing profitability: Using a dashboard which displays spending amounts by merchant category, Cary noticed that millennials living in major cities were spending significantly less at gas stations and more at restaurants than older demographics. Currently, Cary’s bank heavily markets one credit card which provides 3% cash back on all gas station purchases and another card that provides 1% cash back on all dining out. Armed with this consumer trending knowledge, and the numbers to back up his claim, Cary was able to make a recommendation to the executive team that if they wanted millennials to increase their card spend, it would make sense to combine dining out and gas station rewards to shift more purchasing to the higher margin credit card product and away from cash or debit.

Improving customer experience: There’s nothing Cary dislikes more than doing all the hard work to get a customer to spend on their card, only to have the transaction abandoned because of technical issues. So, when Cary kept receiving an alert telling him about a cluster of slow transactions on Friday afternoons, he was keen to get to the bottom of it. Cary used a dashboard to determine that these slow transaction were all within a small geographic area and routed through the same payment switch. Cary notified the IT team and they were able to diagnose the problem and make upgrades that allowed the switch to process higher volumes of transactions. More successful transactions, fewer headaches for Cary, higher revenues and customer satisfaction ratings for the bank.

Mitigating fraud: Prior to his use of card analytics, Cary had to rely exclusively on his card processor for fraud detection. Cary read about some recent card breaches that affected other banks and wanted to protect his card base against similar attacks. Cary knew from reading the details that certain unusual patterns can be indicators of these type of attacks, for instance the same card being used in multiple locations in a short amount of time, or the velocity of transactions around cards used at one or multiple ATM locations. Using his new analytics tools, he set up a series of alerts which told him whenever these potentially fraudulent transaction patterns occurred and needed further examination.

Interested in becoming more like Cary? Contact INETCO, and let’s talk about analytics.