This holiday season kicked off a couple weeks ago, with Black Friday and Cyber Monday showing a 14% increase in early holiday purchases from the same period during 2018, according to a report by Bank of America Merrill Lynch Global Research. With holiday sales projections showing similar numbers until the end of the year, there has never been a more vital time to ensure that consumer transactions are completing as expected.

For EVERTEC, one of the largest merchant acquirers in Latin America, maintaining customer service levels is integral to their business, no matter the time of year. While the holiday season brings an increase in transactions for any payment processor, EVERTEC consistently processes over two billion transactions every year. To most, that would be the dream. To EVERTEC, it is just the beginning.

EVERTEC Costa Rica S.A. knew that in order to grow long-term business with their retail customers and expand market share, they would need to exceed customer service level expectations and improve proactive problem resolution. A huge part of ensuring customers could issue, process and accept transactions securely relied on the Company’s ability to:

- Manage the growth of the ongoing cash-to-card conversion and shift to electronic payments

- Introduce new value-add business solutions and new forms of payment without risk of service disruption

- Continuously capture and analyze data throughout the entire transaction processing value chain – while remaining PCI compliant

EVERTEC Costa Rica S.A. chose real-time payment transaction data specialists, INETCO, to proactively identify and resolve the root cause of transaction performance issues before they affect consumer experience and customer profitability.

“INETCO Insight empowers us to know, within seconds, when something is going wrong with one of our customers,” says Miguel Arcocho, CIO for EVERTEC Costa Rica. “EVERTEC Costa Rica has now proven its ability to exceed customer service level expectations by moving from a reactive to a proactive service model.”

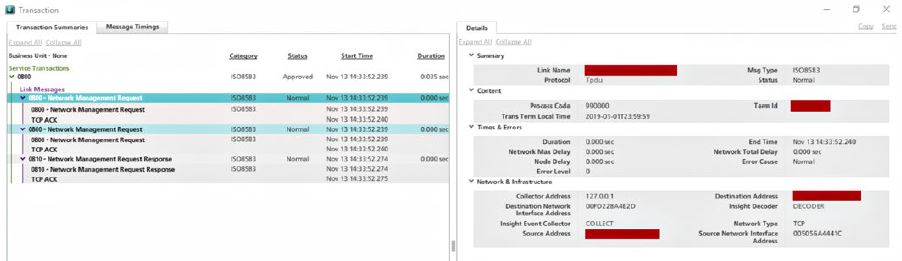

The INETCO Insight solution provides the EVERTEC Costa Rica network operations center (NOC) and technical support team a one-stop, real-time view into every end-to-end transaction journey. Instead of spending hours re-creating an event or waiting for it to happen again, EVERTEC Costa Rica can now, within seconds, understand the root cause of suspicious transaction monitoring activity loss, time outs and unexpected failures related to:

- A connection loss with an incoming payments channel, core banking or payments network

- A telecommunications or network-level communications problem

- A configuration issue with an inactive component such as the firewall, switch or server

With the implementation of INETCO Insight, EVERTEC Costa Rica has been able to improve customer experience delivery, operational efficiency and profitability. EVERTEC believes that real-time, end-to-end visibility of all the moving parts that could disrupt customer service levels has helped them grow long-term relationships with retailers and expand market share by:

- Continuously monitoring customer service level performance at the transaction-level

- Proactively identifying transaction, host, network and application performance issues before they impact consumer transactions and customer service levels

- Speeding up troubleshooting and research of transaction anomalies, chargebacks, reversals, bottlenecks and failures

- Lowering support costs, consolidating tools and monitoring the end-to-end transaction processing solutions, across numerous payment channels and geographic markets, from one central location

For more information on how EVERTEC Costa Rica is using INETCO Insight to improve customer service levels and proactive problem resolution, you can read the full case study, or contact me directly.