Supporting a profitable strategy through reduced fraud loss, deeper analysis of customer interactions and end-to-end ATM management

The ATM channel continues to evolve as a part of digital and branch transformation. What used to be a “cash-and-dash” solution is now a critical connection point in a customer’s financial journey. While the ATM channel remains a strategic part of a healthy banking ecosystem, the big challenge lies in effective ATM management and maintaining ATM fleets as a profitable delivery channel.

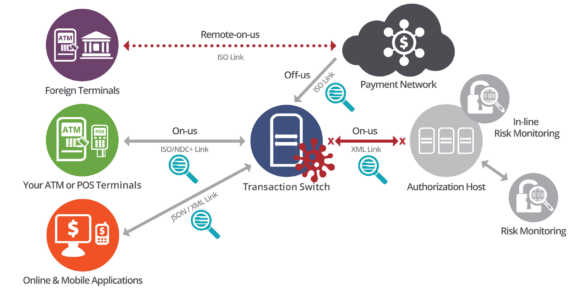

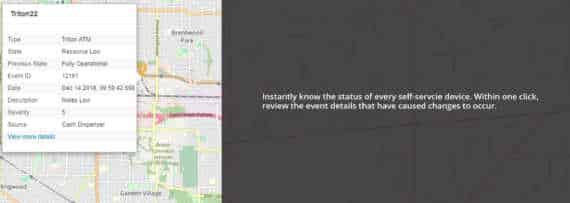

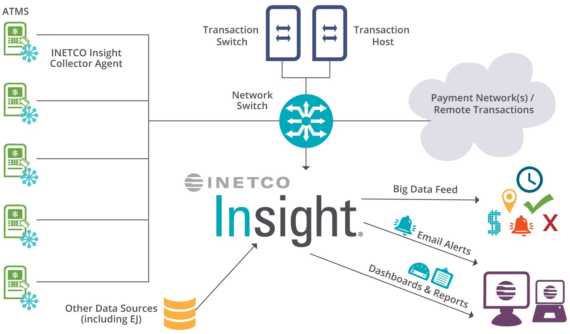

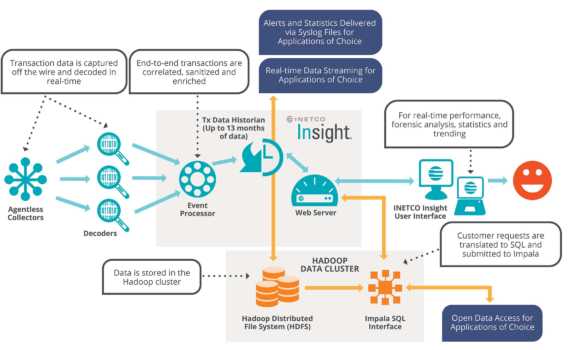

INETCO solutions help financial institutions, payment service providers and IADs manage the end-to-end customer experience, thanks to our ATM monitoring software. Reduce the operational costs and resource time associated with our ATM management system.

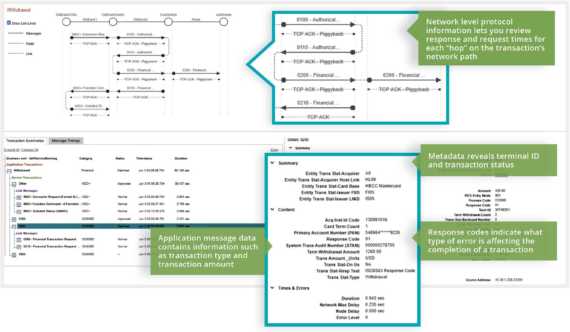

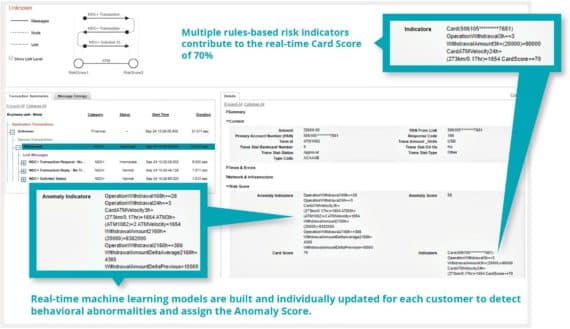

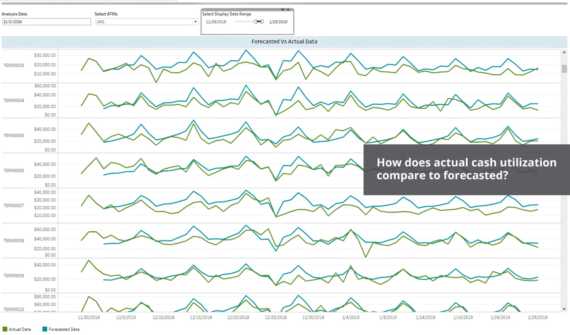

- Continuously gather transaction intelligence across the end-to-end ATM network to understand where, when and how customers interact.

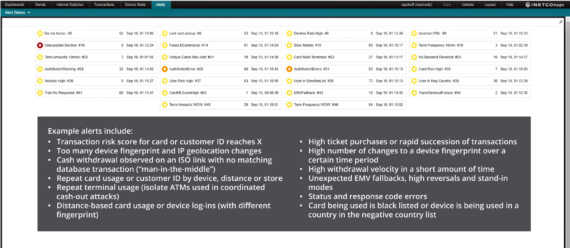

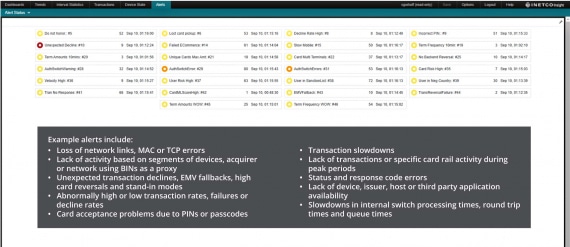

- Detect suspicious transaction activity before it impacts reputation, customer experience and the financial bottom line.

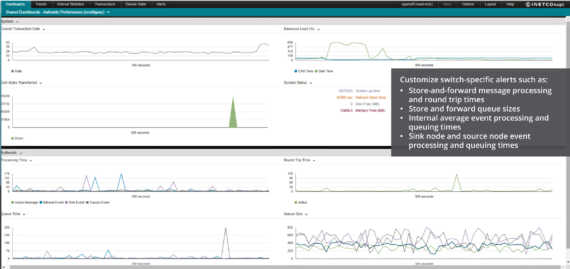

- Improve transaction completion rates by isolating the root cause of transactions that are unexpectedly declined, failing or performing sub-optimally ~85% faster.