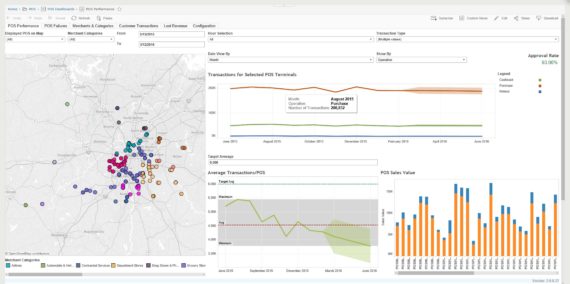

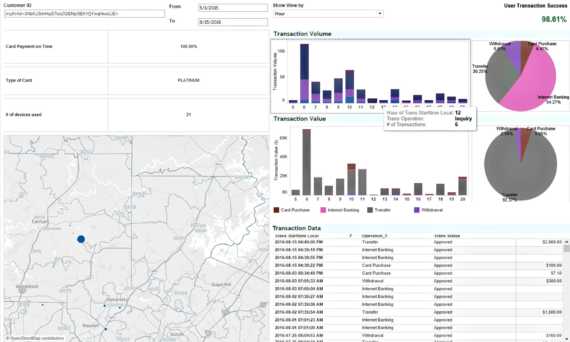

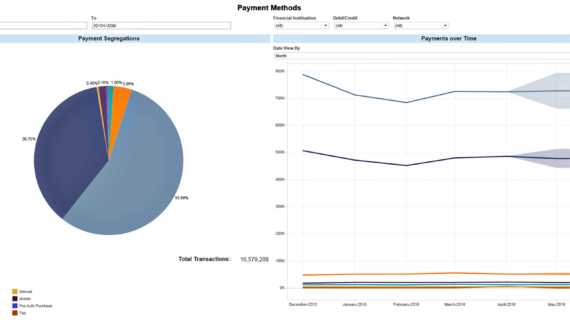

Providing customer interaction analytics for channel managers, customer experience teams and analysts to make faster, more impactful decisions around payment revenue and customer service

Customer habits and behaviors are continuously evolving. For channel managers, customer experience teams and analysts to keep up with when, how and why customers are engaging with their organization, they need easy access to payment transaction data – in an timely, cost effective way.

INETCO Insight delivers “ready to analyze” payment data and customizable analytics dashboards designed to help you gain deeper knowledge of customer interaction analytics, channel performance, fraud liability and profitability across ATM, POS, Card, Mobile, Online and Real-time Payments channels.