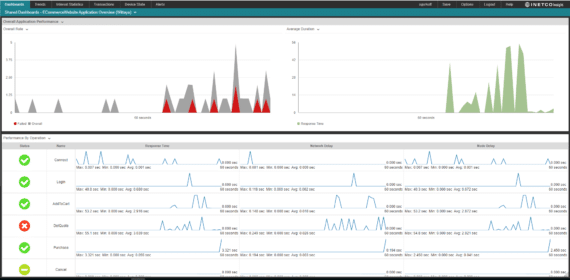

Providing IT operations, channel systems and payment operations teams with real-time operations management software to confidently manage the completion of every payment transaction

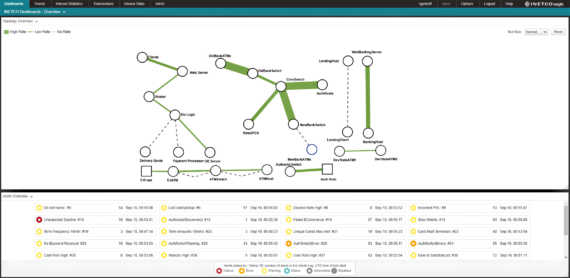

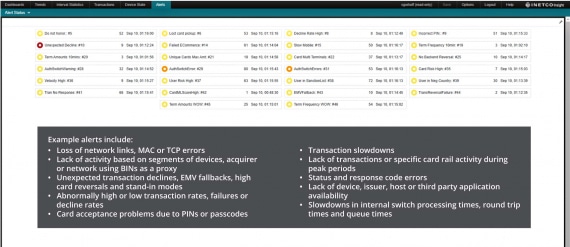

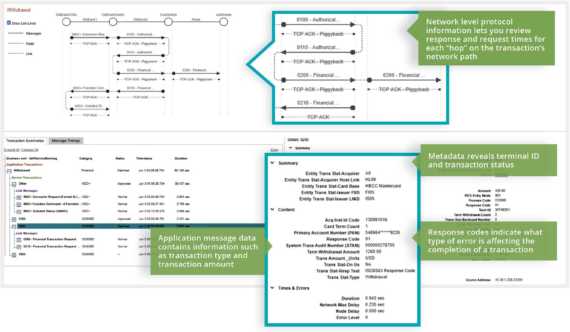

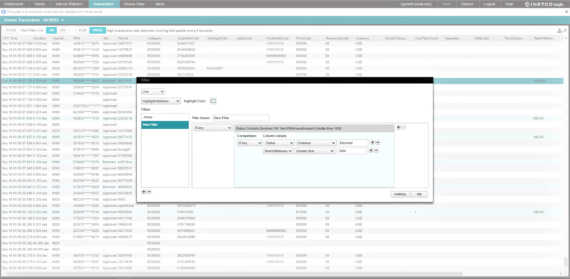

Digital transformation has resulted in increasing channel complexities, more third party applications and a higher volume and velocity of payments data. To make sure every payment transaction completes as expected, IT operations management, channel systems and payment operations teams must be able to immediately isolate performance issues and connectivity issues anywhere along the end-to-end transaction path.

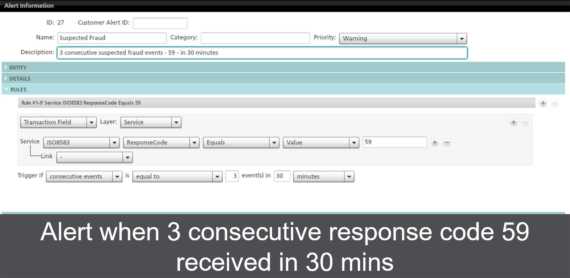

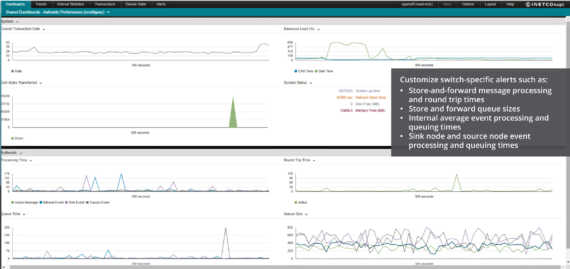

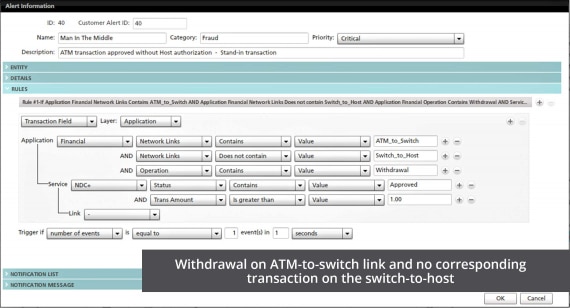

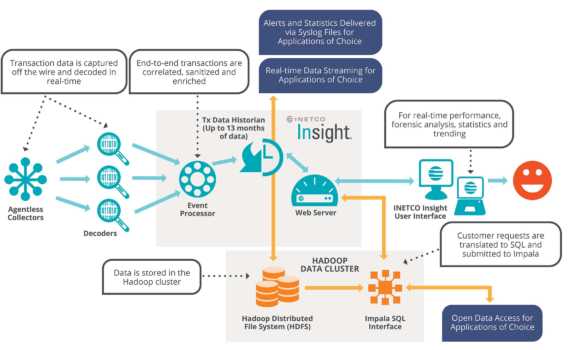

With the INETCO Insight real-time transaction monitoring and analytics software, you gain an advanced early warning system that will continuously screen transaction performance and help you speed up troubleshooting across all self-service, real-time payments and digital payment channels.