Helping C-level executives work together to transform their business and adopt faster payments solutions – one transaction at a time

Growing customer expectations, increasingly sophisticated fraudsters, and payment technology advancements are reshaping the financial industry. They are creating an imperative for C-suite executives such as CTOs, CIOs, CISOs, Chief Digital Officers and Chief Data Officers to work closely together – as all play key roles within strategic initiatives such as digital transformation, open banking, faster payments, and increasing the customer base while growing the wallet share of existing customers.

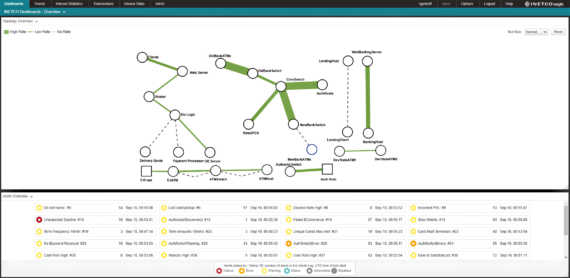

When it comes to improving cross-team collaboration, speeding up modernization and driving more business value from your payments data, INETCO Insight is here to help you move towards faster payments.